You've negotiated the perfect price per kilo for a container of green beans. Then the shipping quote arrives. The number is a shock—it's double what you budgeted. Suddenly, your profitable order looks like a loss. This scenario kills deals and strains relationships. The problem isn't just the cost; it's the surprise.

Calculating shipping costs for bulk coffee requires understanding all the components beyond the basic freight charge. The total landed cost includes the ocean freight rate, fuel surcharges (BAF), currency adjustments (CAF), terminal handling charges (THC), customs duties, insurance, and inland trucking. To get an accurate estimate, you must know your Incoterms, exact volume/weight, and current market rates.

So, how do you move from a shocking surprise to a predictable cost? You need to break down the shipping quote line by line. Let's demystify each component and build a framework for an accurate calculation.

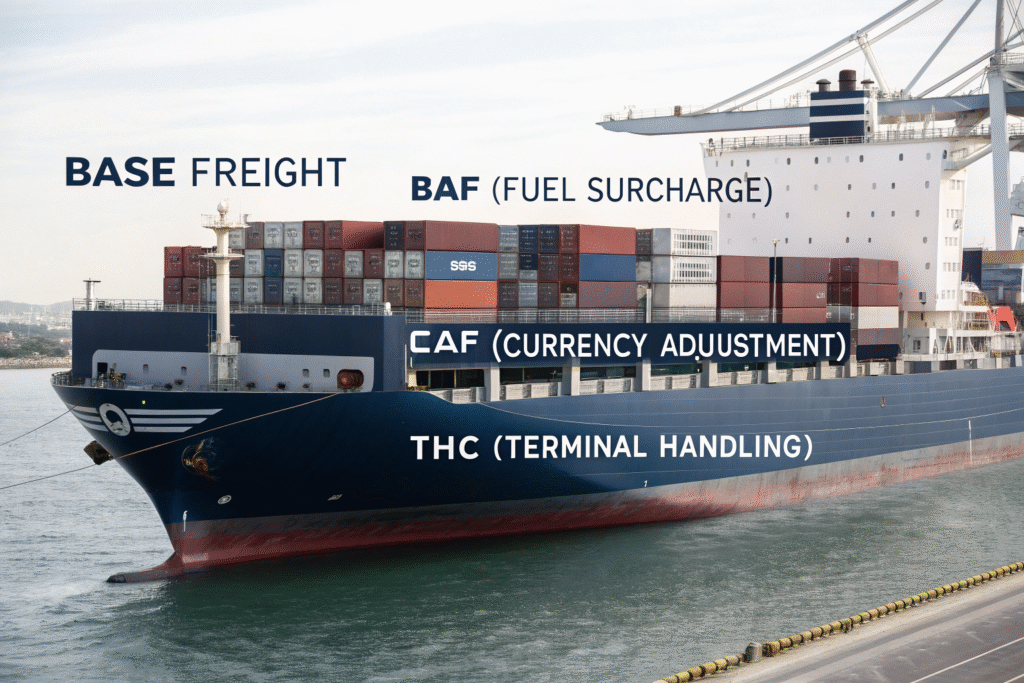

What Are the Core Components of an Ocean Freight Quote?

An ocean freight quote is not a single number. It's a sum of various charges levied by the shipping line and port terminals. Missing just one can throw your entire budget out the window.

The core components are the Base Ocean Freight rate, the Bunker Adjustment Factor (BAF), the Currency Adjustment Factor (CAF), and the Terminal Handling Charges (THC). These four typically form the heart of your shipping line costs.

What Do BAF and CAF Really Mean?

BAF is a fuel surcharge. It's the shipping line's way of passing on volatile fuel costs to you. It changes frequently, sometimes monthly. CAF is a currency adjustment. If the freight is priced in USD but the line's costs are in another currency (like EUR), they use CAF to manage exchange rate risk. These are not fixed costs. You must ask for the current BAF/CAF percentages when getting a quote. This is a fundamental part of international shipping cost management.

How Are THC Charges Calculated?

THC, or Terminal Handling Charges, are fees for moving your container between the ship and the yard at both the origin and destination ports. They are not set by the shipping line but by the port terminal operators. They are typically a fixed fee per container size (e.g., 20ft or 40ft). For a 40ft container from China to the US West Coast, you would budget for THC at both the Chinese port (e.g., Shenzhen) and the US port (e.g., Long Beach). These port charges are often overlooked in initial estimates.

How Do Incoterms Define Who Pays What?

This is the most critical concept in international shipping. Incoterms are a set of three-letter rules that define the responsibilities and costs split between the buyer and seller. Choosing the wrong one can leave you with unexpected bills.

Incoterms clearly specify who is responsible for the freight, insurance, and risk at each stage of the journey. For bulk coffee, the most common terms are FOB (Free On Board) and CIF (Cost, Insurance, and Freight).

What is the Difference Between FOB and CIF?

With FOB (Free On Board), you, the buyer, take control and all costs once the goods are loaded onto the ship at the origin port. This means you pay for the main ocean freight, insurance, and all destination costs. With CIF (Cost, Insurance, and Freight), the seller pays for the ocean freight and insurance to get the goods to your destination port. You are responsible for all costs and risk from that point onward. Many US buyers prefer FOB for more control, while CIF can be simpler for first-time importers. Your choice here directly impacts your logistics management burden.

Why Does the Incoterm Determine Your Risk?

The point where risk transfers from seller to buyer is defined by the Incoterm. Under FOB, if the container falls into the ocean during loading, it's typically the seller's problem. If it happens mid-ocean, it's your problem. This is why marine insurance is non-negotiable. Understanding this split is not just about cost—it's about managing risk in your supply chain. We always clarify Incoterms with our partners at BeanofCoffee to ensure there are no misunderstandings.

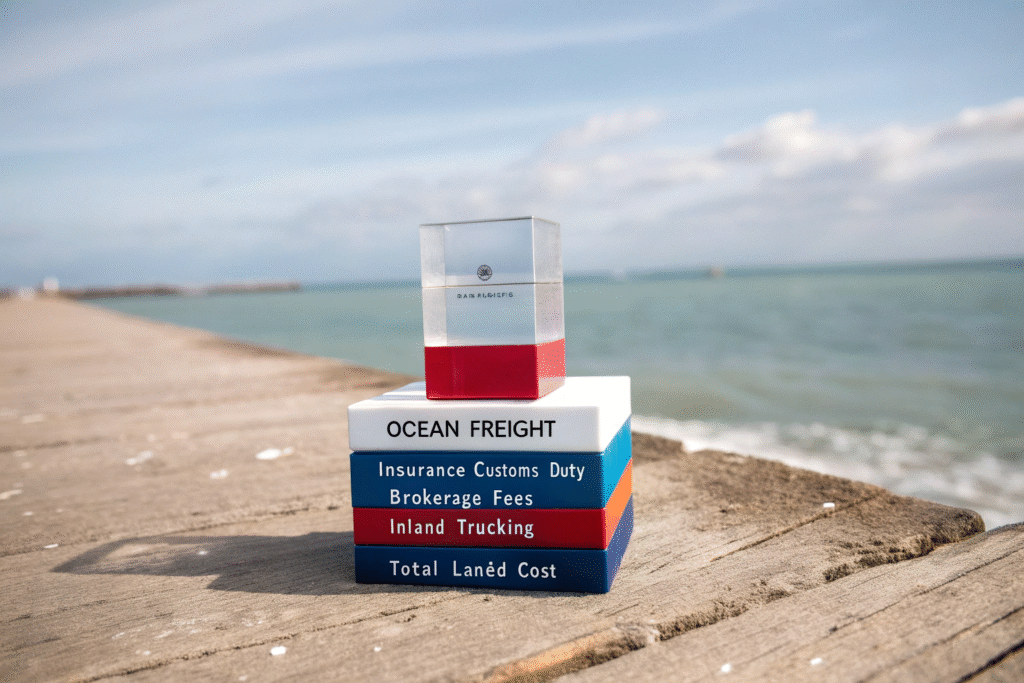

What Hidden Costs Can Inflate Your Final Bill?

The "sticker shock" doesn't usually come from the ocean freight. It comes from the dozens of smaller fees that you didn't know to ask about. These are the hidden costs that sink budgets.

Beyond the core ocean charges, you must account for insurance, customs brokerage, import duties, and inland freight. These are often paid separately from the main freight bill and are easy to miss in initial planning.

How Much Should You Budget for Insurance?

Marine insurance typically costs 0.2% to 0.5% of the cargo's value. For a $100,000 shipment of green coffee, that's $200 to $500. This is a small price for massive peace of mind. It covers you for losses like the ship sinking, containers being lost overboard, or fire. Don't assume it's included—under FOB, it's usually your responsibility to arrange it. This is a critical part of your financial security.

What Are Customs Duties and Brokerage Fees?

When your coffee arrives in the USA, you must pay U.S. Customs. The duty rate for green coffee is generally low, but you must use the correct HTS code (e.g., 0901.11.00). You also need a customs broker to file the entry paperwork for you. Brokerage fees can range from $200 to $500 per shipment. These import compliance costs are unavoidable and must be part of your landed cost calculation from day one. Resources like the U.S. Customs and Border Protection website are essential for verifying current rates.

How Can You Create an Accurate Shipping Cost Estimate?

Now, let's turn this knowledge into action. A proper calculation is a step-by-step process that leaves no room for surprises. It transforms you from a passive recipient of quotes into an informed partner.

To build an accurate estimate, start with the product volume, select your Incoterm, get a detailed freight quote, and then layer on all the additional destination and regulatory costs. Using a simple spreadsheet is the most effective method.

What is the Step-by-Step Calculation Process?

Let's build a sample cost for a 20ft container (FCL) from China to Los Angeles.

| Cost Component | Estimated Cost (USD) | Responsible Party (FOB) |

|---|---|---|

| 1. Product Cost | $50,000 | Buyer |

| 2. Origin Charges (THC, Docs) | $400 | Seller |

| 3. Ocean Freight (Base + BAF/CAF) | $3,200 | Buyer |

| 4. Marine Insurance (0.3%) | $150 | Buyer |

| 5. Destination THC | $900 | Buyer |

| 6. Customs Duty (HTS 0901.11.00) | ~$0 | Buyer |

| 7. Customs Broker Fee | $350 | Buyer |

| 8. Inland Trucking to Warehouse | $800 | Buyer |

| Total Landed Cost | $55,400 |

This table shows how the costs stack. The product cost is just the beginning.

How Can You Simplify This Process?

The simplest way is to partner with a supplier who provides transparency. At BeanofCoffee, we help our clients build these estimates by providing clear FOB costs and connecting them with reliable freight forwarders. This eliminates guesswork and builds a partnership based on trust and predictability, which is the ultimate goal of efficient supply chain management.

Conclusion

Calculating shipping costs for bulk coffee is a detailed but manageable process. The key is to look beyond the base ocean freight and account for all surcharges, insurance, duties, and inland logistics. Your choice of Incoterms fundamentally shapes your costs and responsibilities.

Mastering this process turns shipping from a dreaded variable into a predictable, managed expense. It allows you to import coffee with confidence, knowing your true landed cost before you ever place an order. For a sourcing partner who provides transparency and support through this entire journey, from our farms in Yunnan to your port of entry, we are here to help. Contact our export manager, Cathy Cai, at cathy@beanofcoffee.com for a detailed, no-surprise cost estimate on your next bulk coffee order.