You've mastered finding quality coffee and negotiating prices. But then comes the shipping contract, and you see acronyms like FOB, CIF, or EXW. It feels like a legal maze. You're worried about hidden costs, who's responsible if the container falls off the ship, and how to get your coffee from a port in China to your warehouse in the U.S. without any nasty surprises. This confusion is a major pain point; a wrong choice here could wipe out your profit margin before the beans even land.

Honestly, the best way to choose the right Incoterm is to find the balance between cost and control that fits your business. For most experienced U.S. buyers like you, FOB (Free On Board) is often the sweet spot, as it gives you control over the main sea freight and insurance, allowing you to leverage your own logistics partners for better rates and service. However, for beginners, CIF (Cost, Insurance, and Freight) can be simpler, though often more expensive.

I've navigated these waters for years, exporting our premium Yunnan coffee from China to buyers all over the world. I've seen buyers save thousands by choosing the right term, and I've also seen others get hit with unexpected fees because they chose the wrong one. This isn't just jargon; it's the blueprint for your entire supply chain. It defines the exact point where the risk—and the cost—transfers from me, the seller, to you, the buyer. Let's demystify these terms so you can choose with confidence.

What are the most common Incoterms for coffee?

When you start looking at contracts, you'll see a dozen different Incoterms, but in the world of international coffee trading, you'll really only encounter three or four on a regular basis. Focusing on these key terms will cover 99% of the situations you'll face. Trying to learn all of them at once is overwhelming and unnecessary.

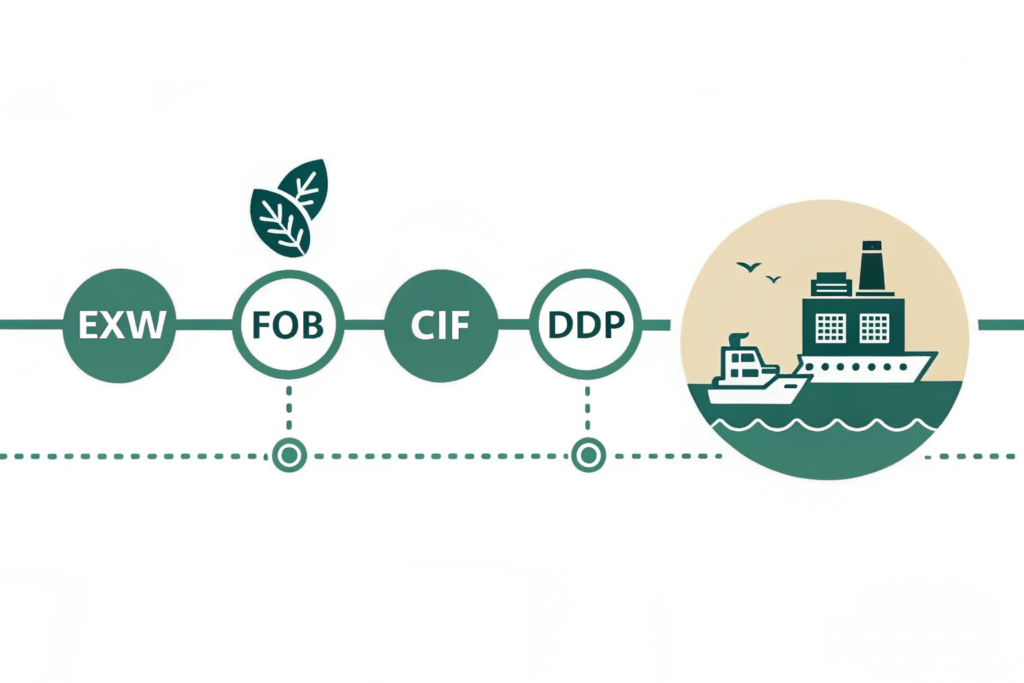

The most common Incoterms for shipping coffee beans are FOB (Free On Board), CIF (Cost, Insurance, and Freight), and EXW (Ex Works). FOB is favored by buyers who want control over shipping, CIF is for those who want the seller to handle it, and EXW gives the buyer maximum control over the entire process, starting from the factory door. Each one represents a different handover point for cost and risk.

Think of it as a relay race. The "baton" is the responsibility for the coffee beans. The Incoterm you choose determines the exact spot on the track where I hand that baton over to you. Understanding these handover points is the key to knowing exactly what you're paying for and what you're responsible for. Let's break down the big three.

What does FOB (Free On Board) really mean?

Under FOB, my responsibility as the seller is to get the coffee beans, cleared for export, and loaded on board the vessel that you have designated at the specified Chinese port (like Shanghai or Shenzhen). The moment the beans cross the ship's rail, the risk and cost transfer to you. From that point on, you are responsible for the main sea freight, the insurance for the ocean journey, and everything that happens after. This is a great option if you have a trusted freight forwarder in the U.S. who can get you competitive shipping rates.

When should you choose CIF (Cost, Insurance, and Freight)?

With CIF, my job is to arrange and pay for everything needed to get the coffee to your destination port in the U.S. (like Long Beach or New York). This includes the cost of the coffee, the insurance for the journey, and the main ocean freight. However, my risk only ends once the goods are loaded on the ship in China. You take on the risk from that point, even though I've paid for the shipping. This term is simpler for you upfront, but you have no control over the shipping line used or the cost, which is often marked up by the seller.

FOB vs. CIF: Which gives you better control?

This is the classic dilemma for most coffee buyers, Ron. It's the choice between convenience and control. On the surface, CIF looks easier. I handle the shipping, you just wait for the boat to arrive. But as a business owner, you know that convenience often comes with a hidden price tag and a loss of control that can hurt your bottom line.

FOB unequivocally gives you, the buyer, better control over your costs and timeline. By choosing your own freight forwarder, you can negotiate better shipping rates, choose faster or more reliable shipping lines, and have direct visibility into your shipment's status. With CIF, you are at the mercy of the seller's chosen logistics partners, which may not be the cheapest or the most efficient.

I always tell my long-term partners at Shanghai Fumao that while we are happy to provide a CIF quote, they should always get their own FOB shipping quote to compare. More often than not, buyers with established logistics relationships find they can save significant money and gain peace of mind by managing the main freight themselves. It's about taking control of a critical part of your supply chain.

How does FOB save you money?

When you control the freight, you can shop around. Your U.S.-based freight forwarder has buying power and relationships with multiple shipping lines. They can find the best rate for the specific lane from China to the U.S. When a seller, like me, arranges CIF, we are often working with a local Chinese agent whose primary interest isn't finding you the lowest price. Furthermore, CIF shipments can sometimes lead to inflated "destination charges" when the container arrives in the U.S., a nasty surprise you avoid when your own forwarder is managing the shipment.

What are the risks of CIF?

The biggest risk of CIF is a lack of transparency and control. The seller might choose a slow shipping line with multiple stops to save money, delaying your coffee's arrival. The insurance included in a CIF term is often the bare minimum (Institute Cargo Clauses C), which may not fully cover potential damages like water damage. By choosing FOB, you can select a more comprehensive "All-Risk" cargo insurance policy that better protects your valuable investment in our high-quality Arabica and Robusta beans.

When should you consider EXW or DDP?

While FOB and CIF are the workhorses of coffee trading, there are two other terms at the extreme ends of the spectrum that are important to understand: EXW (Ex Works) and DDP (Delivered Duty Paid). These represent the absolute minimum and maximum levels of seller responsibility. They aren't used as often, but in certain situations, they can be the perfect solution.

EXW (Ex Works) is best for buyers who want total control and have a strong logistics network within the exporting country, as it makes you responsible for everything from the factory door. DDP (Delivered Duty Paid) is for buyers who want zero logistical hassle, as it makes the seller responsible for everything, including import customs and delivery to your final address.

Think of it this way: EXW is the ultimate "I'll handle it" option, giving you the power to manage every single step. DDP is the "white-glove" service, where you just tell the seller where you want the coffee, and it shows up. We at Shanghai Fumao have the capability to handle either, but the choice depends entirely on your business model and risk tolerance.

Why would a buyer choose EXW (Ex Works)?

You might choose EXW if you are a very large buyer consolidating shipments from multiple suppliers in China. For example, if you're buying our coffee from Yunnan and also tea from a supplier in Fujian, your logistics agent could arrange to pick up both shipments from the respective factories and manage the entire export process. This can be highly efficient and cost-effective at a large scale. However, it means you are responsible for Chinese inland transport, export customs clearance, and all associated risks, which is a major undertaking for most buyers.

Is DDP (Delivered Duty Paid) a good idea?

DDP sounds like a dream come true. I, the seller, handle everything: shipping, insurance, U.S. customs clearance, import duties, and even the final truck delivery to your cafe. While it offers maximum convenience, it is the most expensive option and carries risks. The seller has to build all potential costs and risks into the price, often with a significant buffer. More importantly, you, as the importer of record in the U.S., are ultimately still responsible for compliance with U.S. Customs. Relying on a foreign entity to handle this can be risky if they are not experts in U.S. import regulations.

How do you negotiate Incoterms with a supplier?

You've decided which Incoterm is best for you. Now, you need to make it part of your purchase agreement. This isn't a battle to be won; it's a collaborative discussion to ensure both parties have a clear, mutual understanding of their roles and responsibilities. A good supplier will be flexible and able to quote you prices based on different Incoterms.

The best way to negotiate Incoterms is to clearly state your preferred term early in the conversation and ask for a detailed price breakdown. For example, say "Please quote me a price based on FOB Shanghai." Then, ask for a separate CIF quote to your nearest port. This allows you to compare the seller's shipping costs against what your own freight forwarder can offer.

This approach makes the negotiation transparent and data-driven. It's not about demanding a specific term but about finding the most efficient and cost-effective solution for the partnership. A refusal from a supplier to quote FOB should be a red flag, as it suggests they may be making a significant, non-transparent profit on the shipping. A transparent partner like Shanghai Fumao will always be willing to work with you to find the best fit.

How should you structure your request for a quote?

Be specific. Don't just ask for a price. Ask for:

- Price per kilogram/pound for the coffee beans.

- The preferred Incoterm and the named port (e.g., FOB, Port of Shanghai).

- Packing details (e.g., 60kg jute bags).

- Estimated lead time to get the goods to the port.

This level of detail ensures you get a comprehensive quote that you can accurately compare with others. It also shows the supplier that you are a professional, experienced buyer.

What if there's a disagreement?

A good partnership is about finding a win-win solution. If a supplier is hesitant about your preferred term, ask them why. They may have valid concerns or limitations. For example, a smaller supplier may not have an export license and can only sell on an EXW basis. Understanding their position is key. If you want FOB but they are pushing CIF, it's fair to ask for a breakdown of their freight and insurance charges. This transparency is the foundation of a long-term, trusting business relationship. If they refuse, it might be a sign that you should look for a more transparent partner.

Conclusion

Choosing the right Incoterm is a strategic business decision, not just a logistical detail. It's about taking control of your supply chain, managing your risks, and protecting your profits. By understanding the key differences between terms like FOB, CIF, and EXW, you can move from being a passive price-taker to an active, empowered buyer. For most U.S. buyers, the control and cost-savings of FOB make it the superior choice, turning logistics from a source of stress into a competitive advantage.

We believe a great partnership is built on transparency and a shared goal of efficiency. We are ready to work with you on any Incoterm that best suits your business needs, providing clear, broken-down pricing to help you make the most informed decision. If you're ready to source high-quality coffee from a partner who will help you navigate the complexities of international trade, please reach out. Contact our specialist, Cathy Cai, at cathy@beanofcoffee.com to start the conversation.