You've negotiated a great FOB price of $3.50 per pound for a container of Yunnan Arabica from Bean of Coffee. You're ready to calculate your profit margin. But if you only budget for that $3.50, you're headed for a nasty surprise. The true cost of landed coffee is often 25-50% higher than the FOB price. These overlooked expenses are the "hidden costs" that can erase your profit, strain cash flow, and turn a promising deal into a financial headache. For a buyer like Ron, who is laser-focused on price and efficiency, understanding and budgeting for these costs is not optional—it's critical for survival and accurate pricing.

So, what are the hidden costs of importing coffee beans? They are the multitude of fees, charges, and risks that layer on top of the base price as the coffee moves from the origin port to your warehouse. They fall into four main buckets: logistics and freight, regulatory and customs, financial and risk, and operational and quality. At Bean of Coffee**, we help our clients anticipate these costs because a successful, transparent partnership means no unwelcome surprises when the invoice arrives.

Let's pull back the curtain on the real cost of importing coffee.

What are the logistics and freight hidden costs?

The ocean freight quote is just the beginning. Once the container is on the water, a cascade of handling and accessorial fees begins. These are often not fully detailed in the initial freight quote.

Think of the journey: origin port handling, ocean transit, destination port handling, and final trucking. Each handoff comes with a price tag.

What are origin and destination port charges?

- Origin Charges (at the supplier's port): These are often bundled into the FOB price but can be itemized. They include Terminal Handling Charges (THC) for loading the container onto the vessel, documentation fees, and sometimes a Customs Clearance Fee for export.

- Destination Charges (at your port): This is where many hidden costs appear. They include:

- Destination THC: Fee for unloading the container at the arrival port.

- Pier Pass or Port Infrastructure Fee: A charge for using port facilities, often based on container value.

- Customs Examination Fee: If your container is selected for inspection (X-ray or physical), you pay a hefty fee—often $500-$1000+.

- Demurrage and Detention: The two most feared words in shipping. Demurrage is a fee charged by the port if the full container isn't picked up from the terminal within the free time (usually 3-7 days). Detention is a fee charged by the shipping line if you don't return the empty container within the free time. Congestion, customs delays, or trucker shortages can quickly rack up hundreds of dollars per day in these charges.

How do fuel and currency surcharges add up?

Freight rates are volatile. The base ocean freight is subject to surcharges that change monthly:

- BAF (Bunker Adjustment Factor): A surcharge for fuel cost fluctuations.

- CAF (Currency Adjustment Factor): Adjusts for currency exchange rate changes between the freight currency (often USD) and the carrier's operating currency.

- PSS (Peak Season Surcharge): Applied during high-demand periods (e.g., before holidays). Your freight forwarder should provide a comprehensive "all-in" rate that includes these, but you must confirm.

What are the regulatory, customs, and tax costs?

Getting the coffee released from customs involves government agencies, brokers, and taxes. This process is bureaucratic and fee-intensive.

You cannot do this yourself efficiently. You will need to hire experts, and their services and the government's take are a significant cost.

What are customs duties and merchandise processing fees?

- Import Duty: The tax levied on your imported goods. For green coffee entering the USA, the duty rate is typically 0%. However, for roasted coffee or coffee with additives, duties apply. You must know the correct HTS (Harmonized Tariff Schedule) code.

- Merchandise Processing Fee (MPF): A fee charged by U.S. Customs for processing the entry, calculated as 0.3464% of the entered value (min $29.22, max $614.35). This is a fixed cost on every shipment.

- Harbor Maintenance Fee (HMF): 0.125% of the cargo's value, paid on imports arriving by sea.

Why do you need a customs broker and what do FDA regulations cost?

- Customs Brokerage Fee: You must hire a licensed customs broker to clear your goods. Their fee can range from $150 to $500 per entry, depending on complexity.

- FDA Regulations: Coffee is a food product regulated by the FDA. Key costs include:

- FDA Prior Notice: Must be submitted before arrival; your broker handles this for a fee.

- FDA Facility Registration: Your US facility (warehouse) must be registered with the FDA (biennial fee).

- Potential FDA Hold/Examination: If the FDA flags your shipment, you pay for sampling, lab testing (to check for pesticides, mold, etc.), and storage while awaiting results. This can cost thousands and cause weeks of delay.

What are the financial, risk, and operational costs?

Beyond direct fees, there are costs related to financing, mitigating risk, and handling the coffee once it's "landed."

These are the costs of doing business safely and professionally, but they are often underestimated in initial planning.

How do payment terms and insurance affect cost?

- Cost of Financing (Letters of Credit): If you use an L/C for payment, your bank charges fees (opening fee, amendment fee, negotiation fee) typically totaling 0.5%-1.5% of the invoice value. This is a direct cost of securing the transaction.

- Cargo Insurance: The FOB term means risk transfers to you once the goods are on the ship. You must insure the cargo. Premiums are usually 0.2%-0.5% of the insured value (CIF value + 10%). It's a small price for peace of mind against loss, damage, or events like "General Average" (where all shippers on a vessel in distress share the loss).

- Foreign Exchange Fees: If paying in a foreign currency, your bank's exchange rate margin is a cost.

What are the post-arrival operational costs?

Once the container is at your door, the spending continues:

- Unloading and Warehousing: Cost of labor to unload pallets and space to store the coffee.

- Quality Control (QC) Testing: You should test moisture content and cup samples upon arrival. This takes time and resources. If a problem is found (mold, off-flavors), you face the cost of rejection, re-negotiation, or disposal.

- Shrinkage and Waste: There is always some loss—a torn bag, spillage, moisture loss (coffee weight can decrease slightly during transit). Factor in 0.5%-1% for this.

How to calculate and budget for total landed cost?

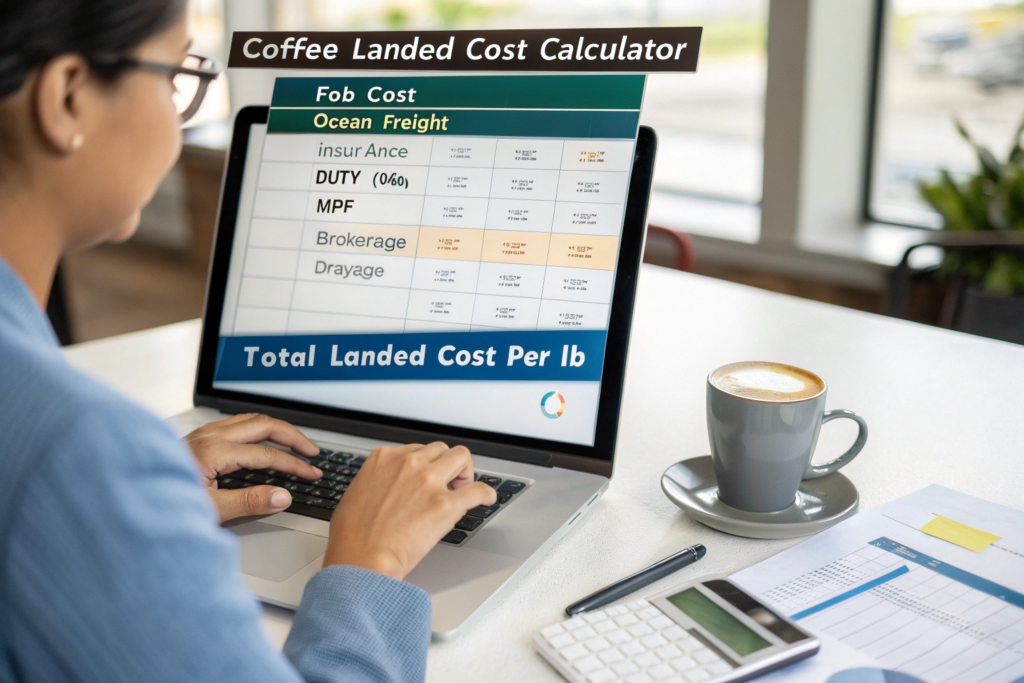

The only way to avoid surprises is to build a detailed Landed Cost Sheet before you place the order. This is your financial blueprint.

A landed cost calculator forces you to account for every possible expense, turning hidden costs into visible, planned ones.

What is the formula for landed cost per pound?

A simple formula is:

Landed Cost Per Pound = (Total of All Costs Below) / Total Pounds in Shipment

Cost Categories to Include:

- Product Cost: FOB price × total pounds.

- Freight & Logistics: Ocean freight, BAF/CAF, origin/destination THC, drayage.

- Insurance: Cargo insurance premium.

- Duties & Taxes: Duty, MPF, HMF.

- Compliance & Brokerage: Customs broker fee, FDA fees.

- Risk & Financing: L/C fees, demurrage/detention (build a contingency of 5%).

- Internal Handling: Unloading, QC, shrinkage.

What are the best practices to mitigate hidden costs?

- Get Detailed Quotes: Demand a comprehensive "all-in" freight quote and a detailed broker fee estimate.

- Build Strong Relationships: A good freight forwarder and customs broker will proactively help you avoid demurrage and navigate exams.

- Order with Lead Time: Rush shipments air freight or express ocean services are exponentially more expensive.

- Factor in a Contingency: Add 5-10% to your landed cost estimate for the unexpected. If you don't use it, it's a bonus.

- Ask Your Supplier for Help: A seasoned exporter like Bean of Coffee can advise on typical destination port charges and reliable forwarder partners.

Conclusion

The hidden costs of importing coffee are the fees, taxes, and risks that live in the space between the FOB price and the coffee sitting ready in your roastery. They encompass logistics (port fees, surcharges, demurrage), regulatory (customs duties, MPF, brokerage), financial (insurance, L/C fees), and operational (QC, handling) expenses. Ignoring them is a direct threat to profitability.

The antidote is meticulous planning. By building a detailed landed cost model for every shipment, you transform hidden costs from budget-busters into predictable line items. This discipline enables accurate pricing, protects your margins, and ensures your import business is built on a foundation of financial clarity, not hope.

Ready to import with eyes wide open? Let's work together to build a predictable cost structure. At Bean of Coffee, we provide clear FOB terms and support with documentation to streamline your process. To discuss your next shipment and get the data you need for accurate landed cost planning, contact our export manager, Cathy Cai, at cathy@beanofcoffee.com. Let's make sure your next great deal is truly great, from price to landing.