You're calculating the landed cost for a container of green coffee, and the tariff question hits you. Get it wrong, and your profit margin evaporates. Get it right, and you can price competitively while avoiding customs delays. The good news? The US is one of the most favorable markets for coffee importers, but navigating the details requires precision.

Most green (unroasted) coffee beans enter the United States duty-free under the Generalized System of Preferences (GSP). However, roasted coffee typically carries a tariff, and certain countries face additional duties or restrictions. The specific rate depends on the coffee's form (green/roasted), origin country, and specific classification under the Harmonized Tariff Schedule (HTS).

So, how do you ensure you're classifying your coffee correctly and not overpaying—or worse, facing penalties for underpayment? The system has nuances that can significantly impact your bottom line. Let's break down the specific codes and scenarios you need to know.

What is the Standard Tariff for Green Coffee Beans?

For the vast majority of green coffee importers, the duty rate is zero. This isn't an accident—it's a long-standing policy designed to support the US roasting industry and ensure a steady supply of raw materials.

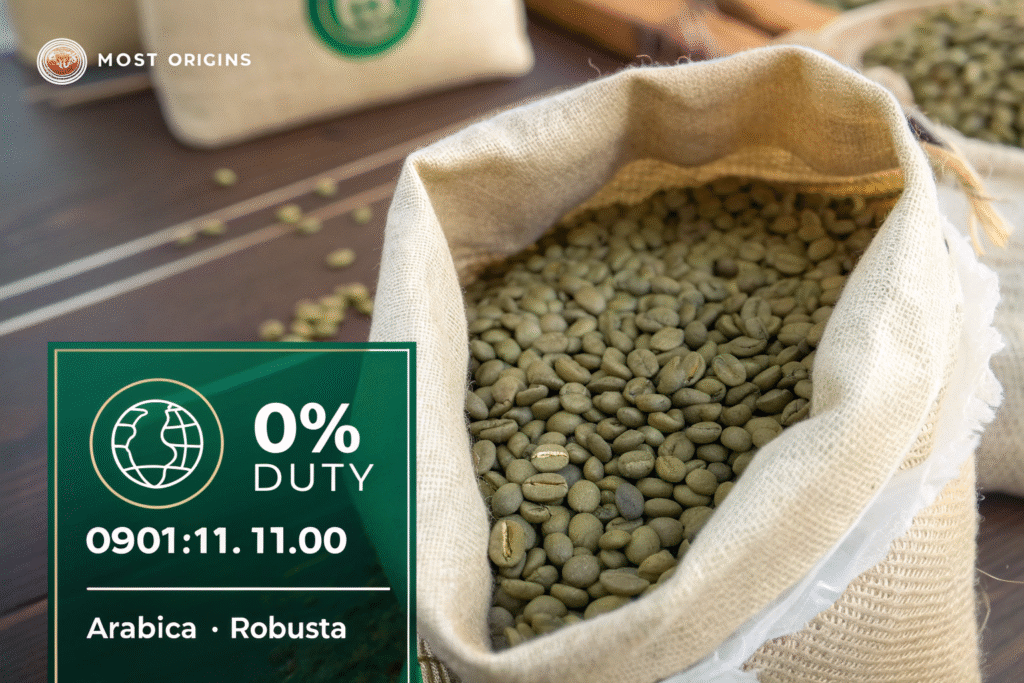

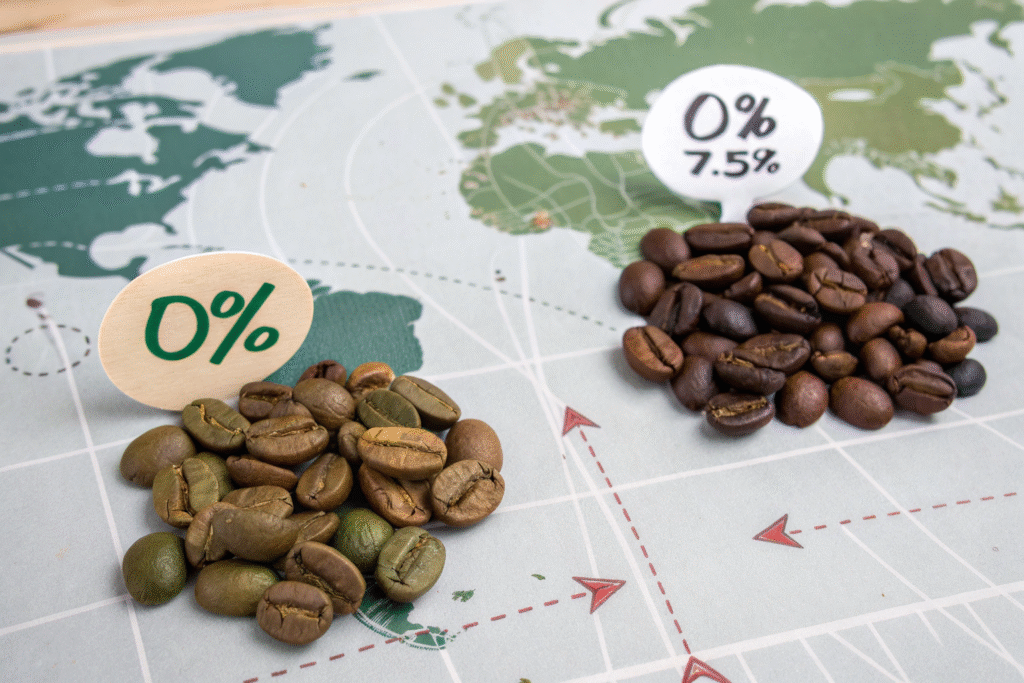

Green coffee enjoys duty-free status under HTS heading 0901.11.00. This applies to both Arabica and Robusta varieties, regardless of the country of origin (with very few exceptions).

Why is Green Coffee Generally Duty-Free?

The US doesn't grow significant commercial coffee, so there's no domestic industry to protect from foreign competition. Making green coffee duty-free reduces costs for American roasters, supporting the massive domestic coffee industry and keeping consumer prices stable. This policy recognizes coffee as an essential commodity rather than a protected agricultural product.

Are There Any Exceptions to This Rule?

While most green coffee enters duty-free, there are two key exceptions:

- Certain Sanctioned Countries: Coffee from countries under comprehensive US sanctions (like Cuba) is generally prohibited.

- Specific Trade Programs: If importing from countries not covered by Most-Favored-Nation status or preferential trade programs, a tariff might apply, but this is extremely rare for coffee.

Always verify the current status of your source country through the U.S. Customs and Border Protection website or your customs broker.

How Much is the Tariff on Roasted Coffee?

This is where costs can appear. If you're importing roasted coffee, the tariff situation changes significantly, reflecting protection for the US roasting industry.

Roasted coffee typically carries a duty, generally falling under HTS heading 0901.21.00. The rate can vary but often ranges from 0% to 7.5%, depending on the country of origin and specific trade agreements.

What is the Typical Rate for Roasted Coffee?

For countries with Most-Favored-Nation status, the tariff is often 0%. However, the base rate can be higher, and specific trade agreements (like USMCA with Canada and Mexico) can reduce or eliminate it. The key is that roasted coffee does not automatically get the same universal duty-free treatment as green coffee. This tariff disparity is why most companies import green beans and roast domestically.

How Does Country of Origin Affect the Rate?

The US has free trade agreements with several countries that may eliminate the roasted coffee tariff. For example:

- CAFTA-DR (Central America-Dominican Republic): Often 0%

- Colombia & Peru under Trade Promotion Agreements: Often 0%

- Other MFN Countries: Varies, but can be 0%

You must have proper documentation proving origin to claim preferential rates.

What Other Fees and Regulations Should You Consider?

The tariff is only one part of the cost equation. Several other regulatory requirements and fees apply to all coffee imports, regardless of duty status.

Beyond the basic tariff, importers must comply with FDA regulations, pay Merchandise Processing Fees (MPF), and potentially other agency requirements. These add to the total cost of importation.

What is the FDA's Role in Coffee Imports?

All coffee entering the US is subject to FDA regulation. You must be a Registered FDA Facility, and your foreign supplier may need to comply with the Foreign Supplier Verification Program (FSVP). While coffee is generally low-risk, the FDA can detain shipments if they suspect contamination or mislabeling. This food safety oversight is mandatory, not optional.

What are the Standard Processing Fees?

Every formal entry into the US requires payment of a Merchandise Processing Fee (MPF). This is currently 0.3464% of the shipment's value, with a minimum fee of $27.75 and a maximum of $538.40. While small compared to potential duties, this is a fixed cost for every shipment. Additionally, your customs broker will charge a fee for their services. These fixed import costs are often overlooked in initial calculations.

How Can You Ensure Compliance and Avoid Problems?

Proper classification and documentation are your best defense against customs delays, audits, and penalties. A small investment in expertise upfront saves significant time and money later.

Working with an experienced customs broker and maintaining meticulous records ensures smooth clearance and protects you from compliance issues.

Why is the HTS Code Classification Critical?

Using the correct HTS code is legally required. Misclassifying roasted coffee as green to avoid duty constitutes fraud with severe penalties. The description must match the product precisely. For example, decaffeinated green coffee has a different HTS code (0901.12.00) than regular green coffee. This precision in classification is non-negotiable.

What Documentation Do You Need?

Beyond the commercial invoice and bill of lading, you may need:

- Certificate of Origin: To claim duty-free status under trade agreements.

- FDA Prior Notice: Submitted before arrival for food products.

- Importer Security Filing (ISF): Required 24+ hours before loading for ocean shipments.

Having this documentation ready prevents costly delays at the port. This paperwork preparedness is as important as the physical shipment itself.

Conclusion

For importers of green coffee beans, the US market offers a favorable duty-free environment under HTS 0901.11.00, making it cost-effective to source raw beans from around the world. The primary costs shift from tariffs to fixed fees like MPF, brokerage, and compliance with FDA regulations. For roasted coffee, the picture is more complex, with tariffs varying by country under different trade agreements.

The key to smooth importing is precise HTS classification, proper documentation of origin, and partnership with a reliable customs broker. Getting it right means your coffee clears customs quickly and your costs remain predictable. For exporters looking to navigate these rules to ship to the US market, understanding the importer's requirements builds strong partnerships. If you are looking for a supplier that provides all necessary documentation for seamless US import, contact our export manager, Cathy Cai, at cathy@beanofcoffee.com. We ensure our shipments are fully compliant, so your focus can remain on roasting and sales.