You're planning your coffee brand's international expansion. Should you focus on the United States with its massive market size, Finland with its incredible per-capita consumption, or China with its explosive growth? Understanding global coffee consumption patterns isn't just trivia—it reveals where opportunities lie today and where they'll emerge tomorrow.

The top coffee consumption countries globally are led by the United States in total volume, followed by Brazil, Germany, Japan, and France. However, when measured by consumption per person, Nordic countries dominate with Finland, Norway, Iceland, Denmark, and Sweden leading. Emerging markets like China and Turkey are experiencing the fastest growth rates, potentially reshaping future rankings.

So, what factors explain why certain countries drink so much coffee, and how should these patterns influence business strategy? The answers involve cultural traditions, economic development, demographic trends, and evolving consumer preferences that create distinct market opportunities. Let's explore the leaders in both total consumption and per-capita intensity.

Which Countries Lead in Total Coffee Consumption Volume?

Total consumption measures the sheer market size in metric tons or bags consumed annually. These markets offer scale but may be mature with slower growth.

The volume leaders represent established coffee cultures with large populations and developed coffee industries. They're essential markets for any global coffee business but often have intense competition.

What Are the Top 5 by Total Volume?

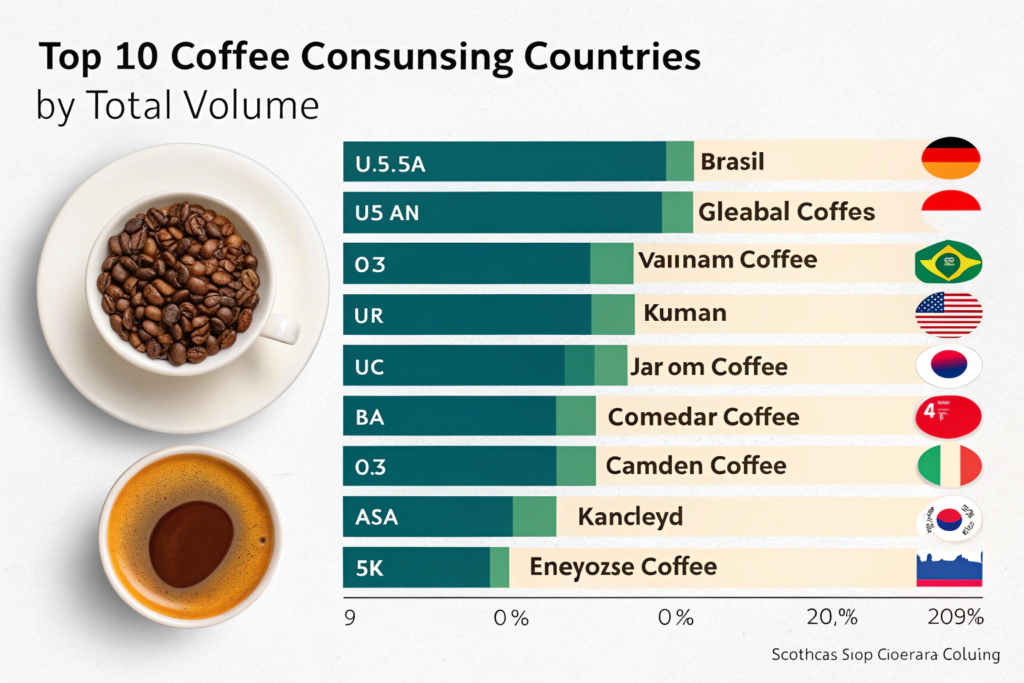

Based on recent International Coffee Organization (ICO) data:

- United States: ~1.7 million metric tons annually

- Brazil: ~1.3 million metric tons (unique as both top producer and consumer)

- Germany: ~1.0 million metric tons

- Japan: ~0.5 million metric tons

- France: ~0.4 million metric tons

These markets account for approximately 40% of global coffee consumption. Their scale makes them indispensable, but their maturity means growth comes from premiumization rather than new drinkers.

Why Do These Countries Consume So Much?

Different factors drive each market:

- United States: Massive population, café culture proliferation, office coffee traditions

- Brazil: Production creates cultural familiarity and affordable availability

- Germany: Traditional filter coffee culture, high disposable income

- Japan: Western influence post-WWII, convenience store and canned coffee revolution

- France: Café society tradition, espresso-based consumption

Understanding these cultural drivers helps tailor market entry strategies for each country.

Which Countries Have the Highest Per-Capita Consumption?

Per-capita consumption reveals coffee intensity within a population. These markets often represent the most sophisticated consumers and highest quality expectations.

Nordic countries consistently top per-capita rankings, reflecting deep coffee integration into daily life and social rituals despite their relatively small populations.

What Are the Top 5 Per-Capita Consumers?

Recent estimates show:

- Finland: ~12 kg per person annually (that's over 1,000 cups!)

- Norway: ~9.9 kg per person

- Iceland: ~9.0 kg per person

- Denmark: ~8.7 kg per person

- Sweden: ~8.2 kg per person

For comparison, the US consumes about 4.4 kg per person, less than half Finland's rate. This consumption intensity makes Nordic markets particularly valuable for specialty coffee despite their smaller populations.

Why Do Nordic Countries Drink So Much Coffee?

Several unique factors:

- Climate: Long, dark winters make warm beverages appealing

- Social tradition: "Fika" (Sweden) and similar coffee break rituals

- Historical availability: Early adoption through trade routes

- Quality focus: High standards and sophisticated palates

- Home brewing: Strong tradition of quality preparation at home

These markets are often leading indicators of global specialty coffee trends due to their educated consumers and quality expectations.

Which Emerging Markets Show the Fastest Growth?

While established markets dominate current consumption, future growth will come largely from emerging economies where coffee is transitioning from luxury to daily habit.

Asia, particularly China and Southeast Asia, represents the most significant growth frontier, with Africa and the Middle East also showing rapid expansion.

How Fast is Chinese Coffee Consumption Growing?

China's coffee market is transforming:

- Growth rate: 15-20% annually, far exceeding global average of 2%

- Driver: Urbanization, younger consumers, café culture explosion

- Unique pattern: Leapfrogging instant coffee directly to specialty

- Local champion: Luckin Coffee's rapid expansion (10,000+ stores)

As the world's largest tea-drinking nation embraces coffee, the market potential is staggering. At BeanofCoffee, we're strategically positioned in Yunnan to supply both China's domestic growth and traditional export markets.

What Other Emerging Markets Matter?

- Southeast Asia: Vietnam, Indonesia, Philippines with young populations

- Middle East: Turkey, Saudi Arabia with traditional coffee cultures modernizing

- Africa: Ethiopia, Kenya consuming more of their own production

- Eastern Europe: Poland, Russia continuing Western adoption trends

These growth markets require different strategies than mature markets, often focusing on education, accessibility, and localization.

How Do Consumption Patterns Differ by Country?

Beyond how much coffee people drink, understanding how they drink it reveals market opportunities for different product types and preparation methods.

Preparation preferences vary dramatically: espresso dominance in Southern Europe, filter tradition in Northern Europe and the US, instant coffee in some Asian markets, and ready-to-drink innovations in Japan.

What Are the Key Preparation Method Divisions?

- Espresso-based: Italy, France, Spain, Portugal (also influencing specialty trends globally)

- Filter/drip: United States, Germany, Nordic countries

- Instant dominant: United Kingdom, Russia, parts of Asia (though changing)

- Traditional methods: Turkey (cezve), Ethiopia (jebena), Saudi Arabia (Arabic coffee)

- Ready-to-drink: Japan (vending machine culture), increasingly global

These preparation preferences determine what products succeed in each market and what equipment you should consider compatible.

How Has Specialty Coffee Changed Consumption?

Specialty coffee has created convergence in some areas:

- Third wave adoption in traditional filter markets (US, Nordics)

- Specialty espresso evolution in traditional espresso markets

- Direct trade interest growing across educated consumer segments

- Brewing education spreading through digital platforms globally

This quality convergence means some consumption patterns are becoming more similar even as traditional differences persist.

What Factors Influence National Coffee Consumption?

Understanding why countries rank where they do helps predict future trends and identify markets ripe for development or premiumization.

Key factors include historical trade patterns, climate, economic development, competing beverages (tea, etc.), and cultural rituals around coffee drinking.

How Do Economic Factors Influence Consumption?

- GDP per capita: Higher income generally correlates with higher coffee consumption

- Urbanization rate: City dwellers drink more coffee than rural populations

- Work patterns: Office culture and commuting influence coffee occasions

- Disposable income: Affects ability to purchase premium coffee

However, economics don't explain everything—cultural factors often override pure purchasing power, as seen in high consumption in relatively lower-income Brazil.

What Role Does Climate Play?

- Colder climates generally show higher hot beverage consumption

- Seasonal variation more pronounced in temperate regions

- Iced coffee adoption growing in warmer climates

- Traditional adaptations like Greek frappé or Vietnamese iced coffee

Climate adaptation has led to localized innovations that sometimes spread globally (like cold brew's rise from warm US markets).

How Should Businesses Use This Information?

Understanding global consumption patterns should inform market selection, product development, and marketing strategy. Different markets offer different opportunities based on their consumption characteristics.

Market entry decisions should consider not just current size but growth potential, competitive intensity, and alignment with your brand's strengths.

What Strategies Work for Different Market Types?

- Mature high-volume markets (US, Germany): Focus on differentiation, premiumization, niche targeting

- High per-capita markets (Nordics): Emphasize quality, sustainability, direct relationships

- Fast-growth markets (China, SE Asia): Invest in education, accessibility, localization

- Traditional markets (Italy, Turkey): Respect traditions while introducing innovation carefully

This segmented approach recognizes that one strategy doesn't fit all markets.

How Do Consumption Trends Inform Product Development?

- RTD growth in convenience-oriented markets like Japan

- Single-serve expansion in time-pressed developed markets

- Specialty green bean demand in quality-focused markets

- Local flavor adaptation in culturally distinct markets

- Sustainability emphasis in environmentally conscious markets

Aligning product development with market-specific consumption patterns increases success likelihood.

Conclusion

The global coffee consumption landscape features established volume leaders like the United States and Brazil, intensity champions in Nordic countries, and future growth engines in Asia and other emerging markets. Understanding both current rankings and underlying trends helps businesses make informed decisions about where to compete and how to win.

The most successful coffee companies develop differentiated strategies for different market types while recognizing convergence in quality expectations globally. Whether you're targeting massive volume, premium margins, or future growth, aligning your approach with each market's unique consumption patterns is essential. If you're developing an international coffee strategy and want insights on specific markets, contact our export manager, Cathy Cai, at cathy@beanofcoffee.com. We work with partners across consumption landscapes and can provide market-specific guidance based on our global experience.