You're negotiating a contract for your next quarter's green coffee supply. The market feels volatile—prices jumped last week on news of frost in Brazil, but you're hearing whispers about a bumper harvest in Vietnam. Making the wrong call could wipe out your margin or leave you unable to fulfill orders. Understanding what moves the needle on coffee prices isn't just for traders; it's essential for anyone whose business depends on a reliable, affordable supply.

Global coffee bean prices are primarily influenced by Brazil's weather, global supply and demand balance, currency exchange rates (especially the Brazilian Real), geopolitical and logistics costs, and speculative trading on futures markets. These factors create a complex, interconnected system where a frost in South America or a tariff change can impact your costs worldwide.

So, how can you anticipate these shifts and protect your business from unexpected price spikes? It starts by tracking the right indicators and understanding how they connect. Let's break down the major price drivers and their real-world impact.

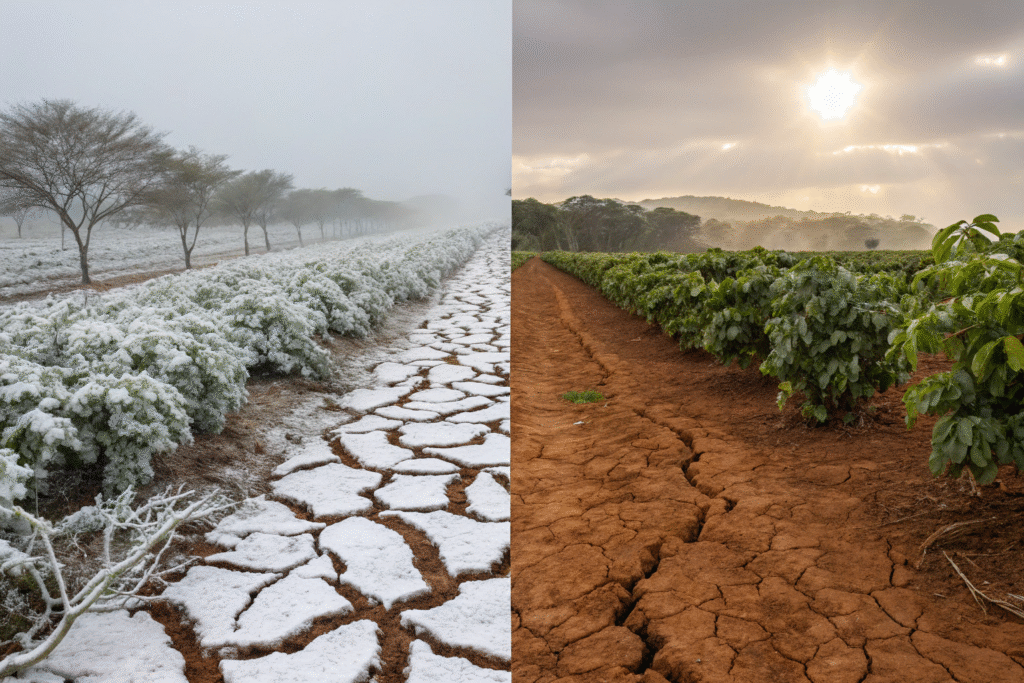

How Does Weather and Climate Disrupt Supply?

Weather is the great wild card of coffee pricing. A single night of frost or a prolonged drought in a major producing country can wipe out millions of bags of coffee, sending shockwaves through the market for years.

Extreme weather events in Brazil—the world's largest coffee producer—have the most significant impact on Arabica prices. For Robusta, weather in Vietnam and Indonesia is crucial. Climate change is increasing the frequency and severity of these disruptions.

Why is Brazil's Frost Season So Critical?

Brazil's frost season (June-August) is the most watched weather event in coffee. A severe frost can damage trees not just for one harvest, but for multiple years, as trees need time to recover. The 2021 frosts in Brazil are a prime example, which contributed to prices doubling over the following year. This isn't just about lost current crop; it's about long-term supply destruction.

How Does Drought Affect Production?

Drought stresses coffee plants, reducing yields and berry size. It also makes trees more vulnerable to pests and diseases. A drought during flowering can be particularly devastating, as it directly reduces the number of cherries that will form. The gradual impact of climate change—shifting rainfall patterns and rising temperatures—is creating a structural deficit in global coffee supply, putting persistent upward pressure on prices.

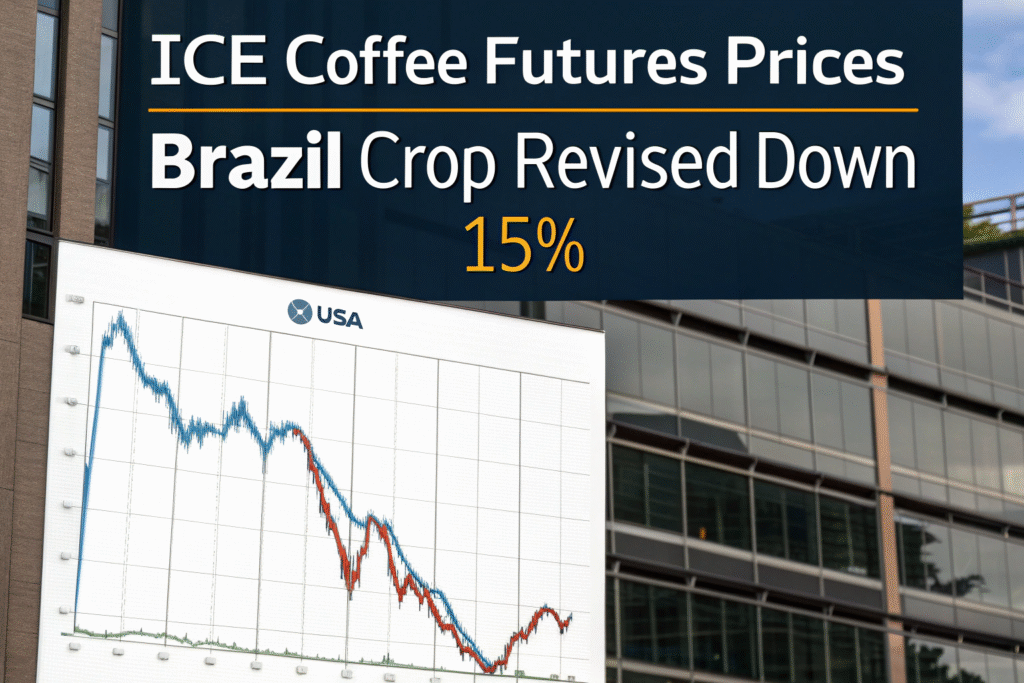

What Role Do Supply, Demand, and Speculation Play?

The fundamental equation of supply and demand is complicated by financial markets and changing consumption patterns. The coffee you drink has been traded as a financial instrument long before it reached your roaster.

The ICE Futures U.S. exchange for Arabica and the London exchange for Robusta set benchmark prices that physical coffee is priced against. These markets are influenced by both physical supply/demand reports and financial speculation.

How Do USDA and ICO Reports Move Markets?

The U.S. Department of Agriculture (USDA) and International Coffee Organization (ICO) publish regular reports estimating production, consumption, and ending stocks in major countries. A report that shows lower-than-expected Brazilian production or higher-than-expected Vietnamese exports can immediately move prices. Traders are constantly anticipating these reports and adjusting their positions. This is where market sentiment becomes as important as physical reality.

Can Speculation Drive Prices Away from Fundamentals?

Yes, in the short to medium term. When financial investors flood into coffee futures, they can create price bubbles that don't reflect the actual coffee sitting in warehouses. However, these distortions typically correct when physical delivery comes due. For physical buyers, this means sometimes paying prices driven more by Wall Street than by farm conditions. Understanding this speculative influence helps explain otherwise puzzling price movements.

How Do Currencies and Geopolitics Impact Your Cost?

The price of coffee is in U.S. dollars, but the costs of producing it are in local currencies like the Brazilian Real or Vietnamese Dong. This disconnect creates another layer of volatility that directly affects your landed cost.

A weaker Brazilian Real makes Brazilian coffee cheaper in dollar terms, as producers are willing to sell at lower dollar prices to get their local currency. Conversely, a strong Real pushes dollar prices up. Geopolitical events can disrupt shipping and add costs.

Why is the BRL/USD Exchange Rate So Important?

Brazil produces about one-third of the world's coffee. When the Real weakens against the dollar, Brazilian farmers have an incentive to sell more aggressively to maintain their income in local currency. This increased selling pressure can lower global Arabica prices, even if the physical supply hasn't changed. It's a classic currency effect that every coffee buyer must monitor.

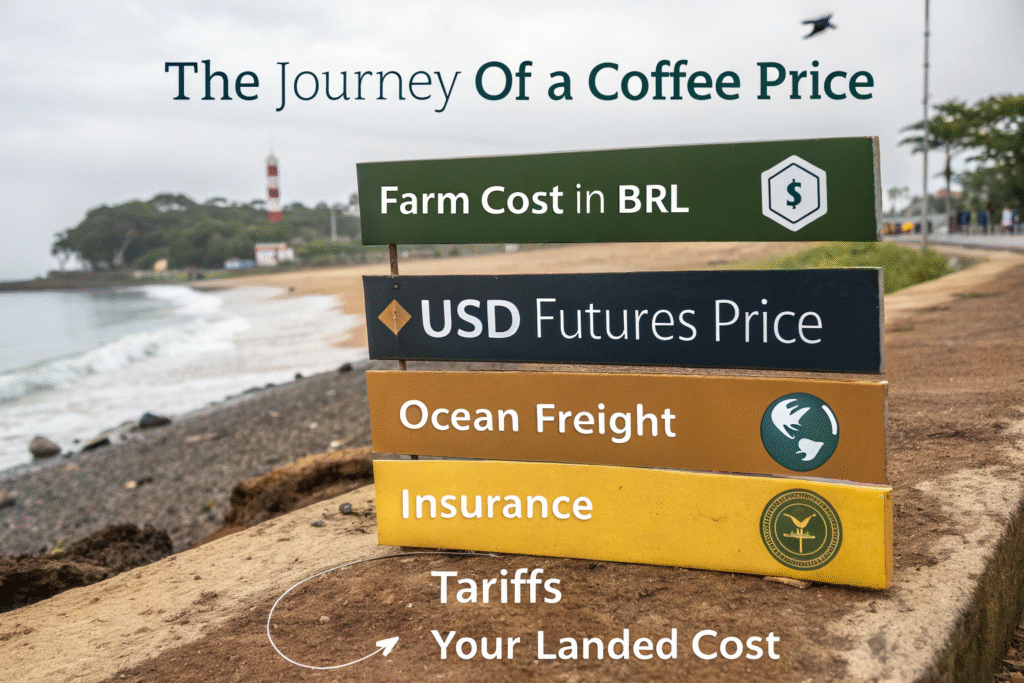

How Do Tariffs and Shipping Costs Add Up?

Trade policies and logistics are a growing part of the cost equation. A new tariff, a blockage in the Suez Canal, or soaring container shipping rates can add cents per pound to your coffee that have nothing to do with the farm gate price. These logistical premiums are becoming a more permanent and volatile component of the total landed cost, especially for buyers sourcing from across the globe like our partners at BeanofCoffee.

What About Production Costs and Sustainability Pressures?

The cost of farming is rising globally, creating a price floor that didn't exist decades ago. When prices fall below the cost of production for too long, farmers abandon coffee, creating supply problems years later.

Fertilizer costs, labor shortages, and the investments required for sustainable certification all contribute to rising production costs. These structural changes are making historically low coffee prices increasingly unsustainable.

Why Are Fertilizer Costs So Significant?

The Russian invasion of Ukraine in 2022 caused a global fertilizer crisis, dramatically increasing one of the largest input costs for coffee farmers. This pushed the break-even price for coffee production higher across the board. Even when the "C" price falls, the true cost of production may support higher physical differentials.

How Does Sustainability Affect Pricing?

Certifications like Organic and Fairtrade often come with higher production costs and lower yields, which are reflected in premium prices. More broadly, the industry is recognizing that unsustainable low prices drive farmer poverty and abandonment, threatening future supply. There's growing pressure to ensure prices cover not just production, but also living incomes for farmers—a factor that may structurally elevate prices over time.

Conclusion

Global coffee prices are a tug-of-war between unpredictable weather and climate trends, financial market speculation, currency fluctuations, and rising structural costs. For buyers, this means building relationships with stable suppliers, understanding the full spectrum of price drivers, and potentially paying premiums for supply chain resilience.

The era of consistently cheap coffee is likely over. The future belongs to buyers who understand this complexity and build diversified, transparent supply chains that can withstand these shocks. If you're looking for a partner that provides price stability through direct farm relationships and transparent costing, we should talk. Contact our export manager, Cathy Cai, at cathy@beanofcoffee.com to discuss how our model at BeanofCoffee can bring more predictability to your sourcing in an unpredictable market.