You're considering opening a coffee shop or launching a coffee brand. The café down the street charges $5 for a latte, and you think, "Coffee is cheap—this must be incredibly profitable!" But when you start calculating rent, labor, beans, and waste, the numbers get confusing fast. Understanding realistic profit margins isn't just about math; it's about survival in a business where many fail despite seemingly high markups.

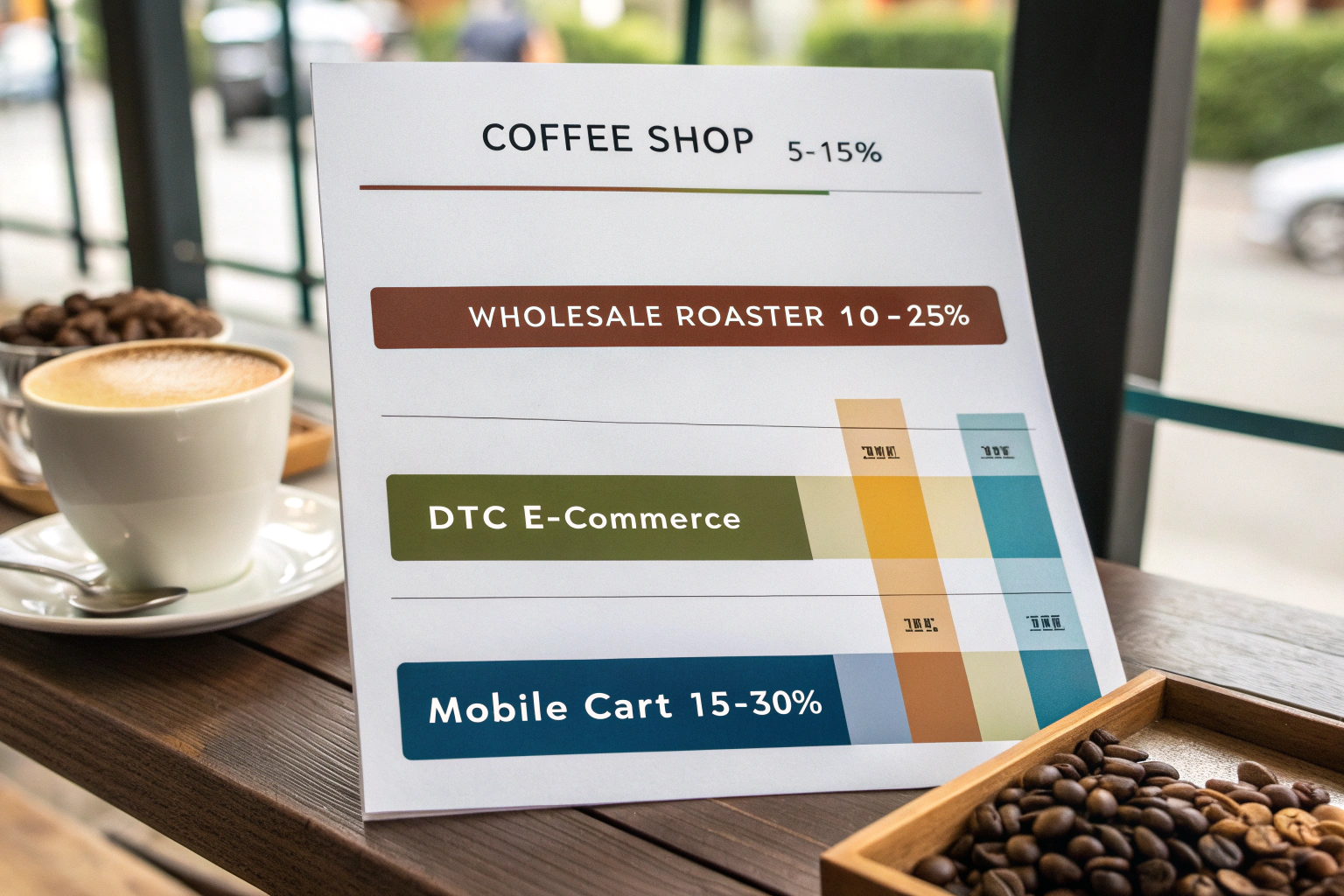

The average profit margin for selling coffee varies dramatically by business model: retail coffee shops typically see 5-15% net profit margin, wholesale roasters 10-25%, e-commerce/direct-to-consumer brands 20-40%, and mobile coffee carts/kiosks 15-30%. These margins are after all operating expenses, not just gross margin on the beans. The wide range depends on scale, location, business efficiency, and value-added services.

So, what specific costs eat into those tempting margins, and how can successful businesses achieve profitability where many fail? The answer lies in understanding both the revenue potential and the often underestimated expenses of coffee businesses. Let's break down the numbers by business model and examine the levers that control profitability.

What Are the Typical Margins for a Coffee Shop/Café?

The coffee shop model faces the highest operating costs, which dramatically compress net profits despite healthy gross margins on individual drinks.

A typical independent coffee shop might achieve 60-75% gross margin on beverages (cost of goods sold at 25-40% of sale price), but after rent, labor, utilities, and other overhead, net profit often falls to single digits.

How Do the Numbers Break Down?

Let's examine a hypothetical $400,000 annual revenue café:

| Category | Percentage of Revenue | Annual Cost | Explanation |

|---|---|---|---|

| Cost of Goods Sold (COGS) | 30% | $120,000 | Coffee, milk, pastries, cups |

| Labor | 30-35% | $120,000-$140,000 | Baristas, managers, benefits |

| Rent & Utilities | 10-15% | $40,000-$60,000 | Location-dependent |

| Other Overhead | 10% | $40,000 | Marketing, repairs, insurance, fees |

| Net Profit Before Tax | 5-15% | $20,000-$60,000 | What the owner actually keeps |

This expense structure explains why many cafés struggle despite busy appearances. Labor is typically the largest cost, not coffee beans.

What Are the Biggest Profit Levers for Cafés?

- Average transaction value: Increasing from $4.50 to $5.50 through food/merchandise

- Labor efficiency: Optimizing schedules to match customer flow

- Waste reduction: Minimizing milk and coffee waste through precise procedures

- Ancillary revenue: Adding catering, wholesale, or events

- Real estate strategy: Balancing premium location costs with foot traffic

Successful cafés like those sourcing from BeanofCoffee often combine premium beans with efficient operations to achieve the higher end of the margin range. This operational discipline separates profitable shops from struggling ones.

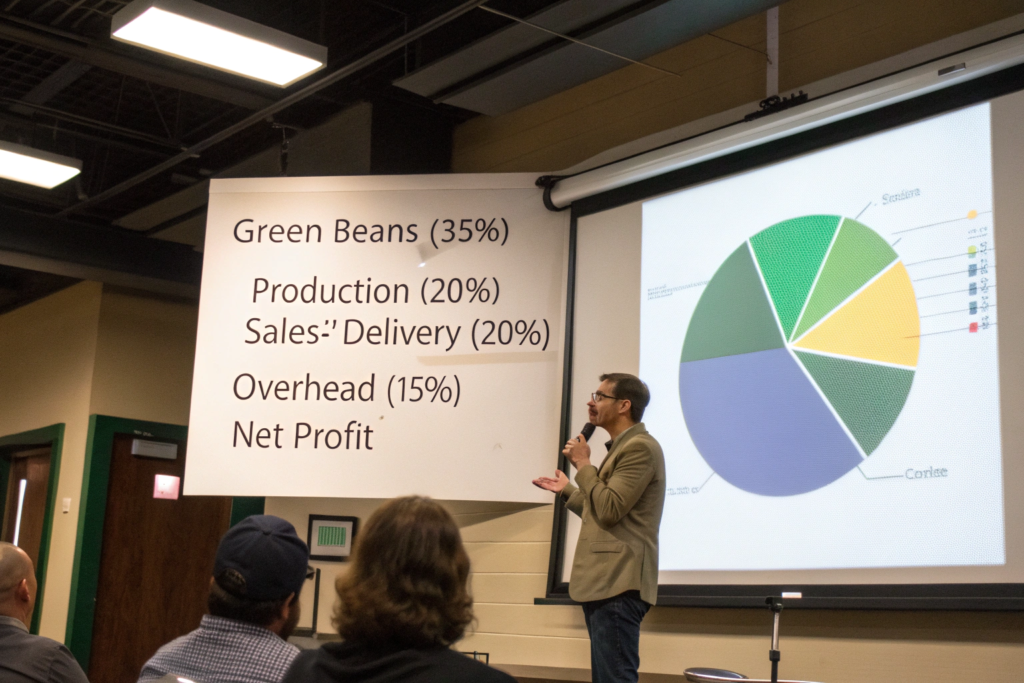

How Profitable is Wholesale Coffee Roasting?

Wholesale roasting typically offers better margins than retail cafes due to lower labor and real estate costs relative to revenue, but requires significant volume and sales effort.

A wholesale roaster sells primarily to cafés, restaurants, and offices. Margins improve with scale as equipment and overhead are spread across more pounds of coffee.

What's the Typical Financial Model?

For a medium-sized roaster doing $500,000 annual revenue:

| Cost Element | Percentage | Key Factors |

|---|---|---|

| Green Bean Cost | 30-40% of wholesale price | Origin, quality, purchasing volume |

| Roasting & Packaging | 15-20% | Equipment, energy, bags, labels |

| Sales & Delivery | 15-25% | Staff, vehicles, fuel, commissions |

| Overhead & Admin | 10-15% | Rent for facility, insurance, software |

| Net Profit Margin | 10-25% | Scale and efficiency dependent |

The volume advantage means a roaster selling 50,000 lbs annually at $10/lb can achieve better margins than one selling 5,000 lbs at $15/lb, despite the lower price per pound.

What Drives Wholesale Profitability?

- Purchase volume: Buying green beans in container loads vs. bags

- Equipment efficiency: High-capacity roasters with lower energy cost per pound

- Customer concentration: A few large accounts vs. many small ones

- Value-added services: Training, equipment maintenance, blend development

- Direct relationships: Sourcing from producers like us at BeanofCoffee to reduce middleman costs

Wholesale success requires balancing quality investment with operational efficiency—customers demand great coffee but won't pay unlimited premiums.

What Margins Can E-commerce/DTC Coffee Brands Achieve?

Direct-to-consumer (DTC) coffee brands selling online often enjoy the highest margins by eliminating physical retail costs and selling at retail rather than wholesale prices.

By shipping directly to consumers, these brands capture the full retail markup while controlling their customer relationships and brand experience.

Why Are DTC Margins Typically Higher?

Comparing to wholesale:

- Selling price: $14-20/lb retail vs. $8-12/lb wholesale

- No middleman: Selling direct captures full margin

- Lower overhead: Often home-based or small facilities initially

- Subscription model: Predictable revenue with lower customer acquisition costs

- Brand control: Full pricing power without retailer negotiations

However, DTC faces significant marketing costs to acquire customers in a crowded online space, which can offset the higher per-pound revenue.

What's the Real DTC Financial Picture?

For a successful specialty DTC brand:

- Gross margin: 60-70% (cost to produce vs. selling price)

- Marketing costs: 15-30% of revenue (ads, influencers, content)

- Fulfillment & shipping: 10-15%

- Overhead & operations: 10-15%

- Net margin: 20-40% for efficient, scaled operations

The customer lifetime value is crucial—acquiring a subscriber who stays 12+ months makes high initial marketing costs worthwhile.

How Do Mobile Carts and Kiosks Compare?

Mobile coffee operations (carts, trucks, kiosks) often achieve better margins than traditional cafés due to dramatically lower real estate costs and flexibility.

With lower fixed costs, mobile operations can be profitable at lower revenue levels, but face challenges of weather dependency, limited space, and sometimes lower average transaction values.

What's the Mobile Advantage?

- Rent/lease costs: 5-10% of revenue vs. 10-15%+ for cafes

- Labor efficiency: Often owner-operated or small teams

- Location flexibility: Can move to high-traffic events or areas

- Lower startup costs: $20,000-$100,000 vs. $100,000-$300,000+ for cafes

- Operating hour control: Open only during peak profitable hours

However, revenue limitations due to smaller menu and space constraints mean absolute profit dollars may be lower even if percentages are higher.

Typical Mobile Operation Margins:

- Gross margin on drinks: 65-75% (similar to cafes)

- Operating costs: 50-60% of revenue (lower rent, but possibly higher per-unit labor)

- Net margin range: 15-30% depending on volume and location efficiency

The scalability limitation means many mobile operators eventually add multiple units or transition to brick-and-mortar to grow beyond a certain revenue ceiling.

What Factors Most Impact Profitability Across All Models?

Beyond business model differences, several universal factors determine whether a coffee business achieves the high or low end of its margin potential.

Understanding these leverage points helps owners focus on what truly moves the profitability needle rather than getting distracted by minor cost savings.

How Critical is Product Mix Optimization?

The most profitable coffee businesses:

- Balance high-margin items (black coffee, tea) with lower-margin drivers (espresso drinks)

- Increase average transaction value with food, merchandise, or add-ons

- Manage inventory carefully to reduce waste and spoilage

- Price strategically based on value perception rather than just cost-plus

- Seasonal offerings that maintain interest and justify premium pricing

This revenue optimization often matters more than cost cutting for achieving healthy margins.

What Operational Efficiencies Make the Biggest Difference?

- Labor scheduling aligned with customer patterns (not just reducing hours)

- Energy efficiency in roasting and equipment

- Supply chain management for consistent quality and cost

- Technology utilization for ordering, inventory, and customer management

- Preventive maintenance to avoid costly equipment failures

The most successful businesses treat operational excellence as a continuous improvement process rather than a one-time setup.

How Can You Improve Your Coffee Business Margins?

Whether you're starting or optimizing, specific actionable strategies can move your business toward the higher end of its margin potential.

Improvement requires both revenue enhancement and cost management, with careful attention to how changes affect customer experience and long-term value.

What Quick Wins Often Exist?

- Audit waste: Measure and reduce coffee, milk, and food waste

- Review portion sizes: Ensure consistency without over-serving

- Negotiate with suppliers: Especially as you grow in volume

- Optimize menu: Focus on profitable items that customers love

- Implement subscription models: For predictable revenue and lower acquisition costs

These tactical improvements can often increase margins by 3-5 percentage points without major investment.

What Strategic Changes Deliver Long-Term Impact?

- Build direct sourcing relationships with producers like BeanofCoffee to improve quality and reduce costs

- Invest in employee training to improve efficiency and reduce turnover

- Develop unique products that command price premiums

- Leverage technology for better inventory and customer insights

- Create community loyalty that reduces marketing costs over time

These strategic investments may initially reduce margins but build sustainable competitive advantages.

Conclusion

Average profit margins in coffee vary from 5-15% for cafes to 20-40% for efficient e-commerce models, with wholesale roasting and mobile operations in between. These margins are achieved after accounting for all operating expenses, not just the cost of beans. The wide ranges reflect differences in business model efficiency, scale, location, and management capability.

Sustainable profitability requires balancing quality investment with operational discipline, optimizing product mix, managing key costs (especially labor), and continuously improving efficiency. While coffee offers the potential for healthy margins, achieving them demands business acumen as much as coffee passion. If you're evaluating coffee business opportunities or seeking to improve your margins through better sourcing, contact our export manager, Cathy Cai, at cathy@beanofcoffee.com. We help partners achieve their profitability goals by providing quality beans that balance cost and value.