You're a buyer, maybe a roaster or a brand owner. You check your email and see a price quote for green beans. Is it good? Is it high? The market feels volatile. You hear about frost in Brazil or droughts in Vietnam, and you wonder how it affects your bottom line right now. It's confusing, and making a costly mistake is your biggest fear.

The current market price of green coffee beans is not a single number but a complex range, primarily driven by the ICE Futures U.S. exchange for Arabica and the London exchange for Robusta. As of late 2023 and into 2024, Arabica prices have fluctuated significantly, often between $1.80 and $2.20 per pound for the benchmark contract, while Robusta has traded higher, sometimes surpassing $2.80 per pound due to supply constraints. However, the price you actually pay is this "C" price plus a differential, which is determined by origin, quality, and your supplier's terms.

So, how do you translate these volatile exchange numbers into a stable, reliable cost for your business? The answer isn't just in watching the charts—it's in understanding the layers that build your final price. Let's peel back those layers and demystify what you're really paying for.

What Factors Are Driving Today's Green Coffee Prices?

The price on the news is just the starting point. It's like the sticker price on a car—nobody pays just that. The final cost is built from a mix of global forces and local realities. Understanding these gives you power in negotiations.

The primary factors driving today's prices are supply chain dynamics, weather anomalies in key growing regions, and global economic pressures. Specifically, droughts in Vietnam and Brazil have squeezed Robusta and Arabica supplies, while high fuel costs and shipping delays have added significant premiums to the final landed cost.

How Does Weather and Climate Impact Supply?

Weather is the great dictator of coffee prices. A frost in Brazil or a drought in Vietnam doesn't just affect farmers there—it sends a shockwave through the entire global market. For instance, when Brazil's Arabica crop is threatened, the "C" price soars because traders anticipate less coffee to go around. This is a fundamental supply and demand shock. We see this firsthand in Yunnan; consistent, predictable weather is why we can offer more stable pricing than regions prone to major climate shocks. The International Coffee Organization provides excellent reports on how climate affects global supply.

Why Are Logistics and Geopolitics a Hidden Cost?

You might think the price is about the bean alone. But honestly, the journey adds a huge chunk. The cost to ship a container from China to the US is still higher than pre-pandemic levels. Geopolitical tensions can close shipping routes or cause insurance costs to spike. Then there are tariffs. These aren't set by the coffee farm; they are a result of international trade policies. When you buy from us at BeanofCoffee, our direct control from farm to port helps us manage these logistics costs more effectively, preventing nasty surprises for our buyers.

How Much Does Origin and Quality Affect the Price?

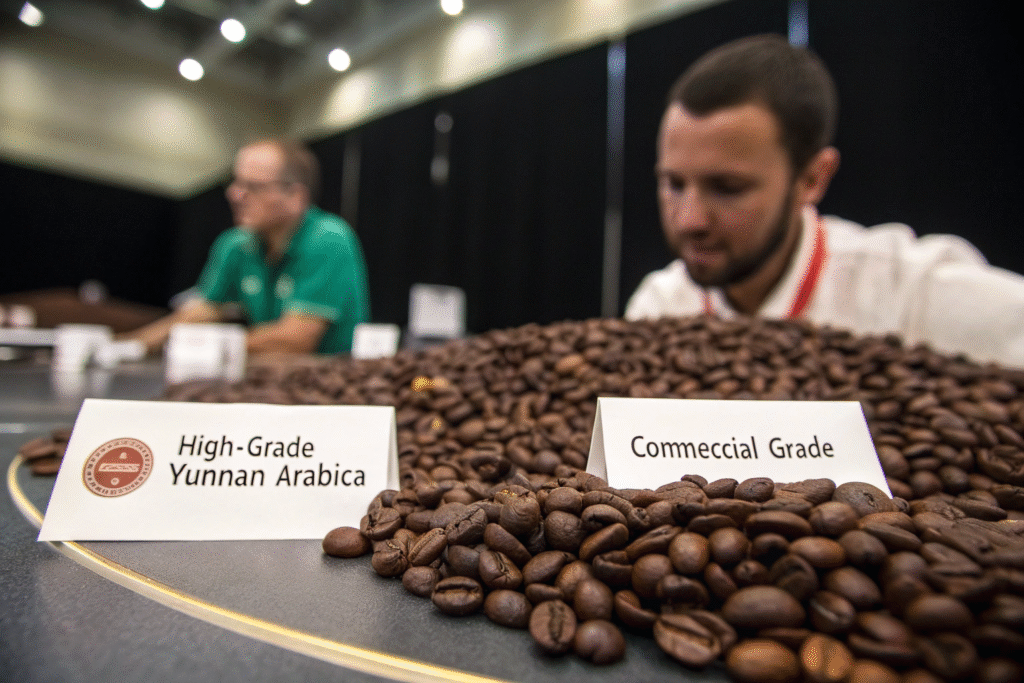

This is where the real differentiation happens. Two bags of Arabica can have wildly different prices. Why? Because the name "Arabica" is just a family name—the individual character of the bean from a specific origin and its quality grade determine its true value.

The origin and quality of green coffee beans can cause the final price to deviate from the "C" price by dollars per pound. A high-grown, strictly hard bean (SHB) Arabica from a renowned micro-lot can command a massive premium, while a standard commercial grade might be priced at a discount.

What is a "Differential" and How is it Set?

The differential (or "diff") is the premium or discount added to the futures market price. Think of it as the bean's report card. A great report card—high altitude, specialty grade, proven cup score—gets a high premium. A poor one gets a discount. This diff is influenced by the reputation of the coffee origin. For example, our Yunnan Arabica, known for its balanced body and chocolatey notes, trades at a specific differential that reflects its unique quality and our reliable, large-scale supply.

Can Certification and Processing Method Add Value?

Absolutely. A certification like Fairtrade or Organic isn't just a label; it's a promise of a specific production method that often costs more, and that cost is passed on. Similarly, the processing method—washed, natural, honey—directly impacts the flavor and the labor required. A natural process coffee often uses more water and careful monitoring, which can add to the cost. These factors are part of the bean's story, and consumers are willing to pay for that. Understanding these coffee certifications is key to justifying the final price to your own customers. The Specialty Coffee Association offers resources on grading and quality that help define these value tiers.

What Are the Real Costs Beyond the Bean's Sticker Price?

The FOB price you see on a quote is just the beginning. To understand your true cost, you have to think about all the steps that get the beans from the supplier's port to your roastery. Missing these can turn a good deal into a money-losing nightmare.

The real landed cost includes the FOB price plus ocean freight, insurance, import tariffs, customs broker fees, domestic trucking, and potential financing costs. For a container from China, these added costs can easily add $0.50 to $1.00 or more per pound to your initial price.

How Do Tariffs and Shipping Calculate into Your Bill?

Let's do some simple math. Suppose the FOB price is $2.00/lb. Ocean freight might be $0.30/lb. Insurance is a small percentage. Then U.S. tariffs—this is a big one. You need the correct HTS code. For green coffee, the duty can be low, but you must pay it. Then your customs broker charges a fee. Finally, trucking from the port to your warehouse adds more. All these logistics costs stack up. A supplier who is transparent about these add-ons, like we strive to be at BeanofCoffee, is worth their weight in gold.

Why is Payment Security a Part of Your Cost?

This is a cost of risk. Sending a $50,000 wire transfer to a new supplier is a risk. If something goes wrong, that money is gone. Using a safer method like a Letter of Credit (LC) costs money in bank fees. But that fee is a form of insurance. It's the cost of ensuring your financial security and peace of mind. It's better to pay a small bank fee than to lose the entire amount. This is a non-negotiable part of the cost for serious, high-volume buyers.

How Can You Secure a Stable and Fair Price?

Chasing the absolute lowest price is often a trap. It leads to unreliable quality and supply. The smarter goal is a fair, stable price that allows for long-term planning. This is where your choice of supplier makes all the difference.

You can secure a more stable price by building a direct relationship with a farm-level exporter, discussing forward contracts to lock in prices, and understanding the total cost structure rather than just the FOB price. Stability comes from partnership, not just transaction.

What is the Benefit of a Forward Contract?

A forward contract is an agreement to buy a set amount of coffee at a fixed price for delivery at a future date. This is your shield against market volatility. If you believe prices are going to rise, you can lock in today's price for the next 3, 6, or even 12 months. This gives you incredible budgeting power. For us at BeanofCoffee, it allows us to plan our harvest and processing schedule with confidence. It’s a win-win that aligns our business planning with yours.

Why Does a Direct Supplier Relationship Matter?

When you buy through multiple intermediaries, each one adds a markup and a layer of opacity. You have no visibility into the true source. By working directly with a supplier who owns the plantations, you cut out those middlemen. You get a more honest price and, just as importantly, direct communication. If there's a problem with the harvest or a delay in shipping, you hear it from the source. This direct line builds the trust that is essential for managing risk and ensuring a stable, long-term supply of quality beans.

Conclusion

The current market price of green coffee beans is a moving target, influenced by everything from the weather to global shipping costs. But for a business like yours, the key isn't to become a full-time market analyst. The key is to find a partner who provides transparency, stability, and fairness within that chaotic market. By focusing on the total landed cost and building a direct relationship, you can transform price volatility from a constant threat into a managed variable.

Stop worrying about daily price swings and start building a sustainable supply chain. If you are looking for a reliable partner with over 10,000 acres of coffee plantations in Yunnan, committed to providing fair, stable pricing and premium Arabica, Catimor, and Robusta beans, let's talk. Contact our export manager, Cathy Cai, at cathy@beanofcoffee.com to discuss how we can provide you with a predictable cost structure for your green coffee needs.