You check the commodity markets on Monday and green coffee prices are stable. By Friday, they've spiked 15% because of frost warnings in Brazil. Your carefully calculated profit margins have suddenly evaporated. If you're a roaster, retailer, or even a consumer, you've felt the whipsaw of coffee price volatility. This isn't just normal market behavior—it's extreme sensitivity to factors that would barely affect other commodities.

Coffee bean prices fluctuate dramatically due to their status as a globally traded commodity with inelastic supply, weather vulnerability in concentrated growing regions, currency exchange effects, speculative trading, and political instability in producing countries. The combination of these factors creates a market that can swing 50-100% in a single year, making coffee one of the most volatile agricultural commodities.

So, what specific mechanisms turn a frost in Brazil or a drought in Vietnam into higher prices for your morning brew halfway around the world? The answer lies in a perfect storm of economic, environmental, and structural factors that amplify even minor disruptions. Let's examine the primary drivers of this relentless price volatility.

How Does Weather Create Global Price Shocks?

Coffee grows in a fragile climatic window that's easily disrupted by weather extremes. Because production is concentrated in specific regions, local weather events can have global consequences.

Weather impacts coffee prices through frosts, droughts, excessive rainfall, and temperature shifts that damage crops or reduce yields. The timing of these events matters as much as their severity.

Why is Brazilian Frost So Feared?

Brazil produces about 40% of the world's coffee, making it the swing producer that balances global markets. Frost events there are particularly devastating because:

- Frost kills coffee trees rather than just reducing yields

- Recovery takes 2-3 years as new trees mature

- The market anticipates long-term shortages when frost hits

- Speculators amplify the price movement based on anticipated deficits

The 2021 Brazilian frosts demonstrate this perfectly—prices doubled over the following year as the market priced in multi-year production shortfalls. This weather amplification effect makes coffee uniquely sensitive to meteorological events.

How Does Climate Change Increase Volatility?

Climate change is making weather patterns less predictable and more extreme:

- Drought frequency is increasing in key regions like Vietnam

- Temperature rises are pushing coffee uphill, reducing viable land

- Erratic rainfall disrupts flowering and harvest timing

- Pest and disease ranges are expanding into new areas

These climate-driven disruptions are becoming more frequent and severe, creating a backdrop of structural volatility that compounds short-term weather events.

What Role Do Currency Markets Play?

Coffee is traded in US dollars but produced in countries with local currencies. This creates a constant translation effect that can dramatically alter farmer incentives and global supply.

When the Brazilian Real weakens against the dollar, Brazilian farmers receive more local currency for their dollar-priced coffee, creating selling pressure that can lower global prices.

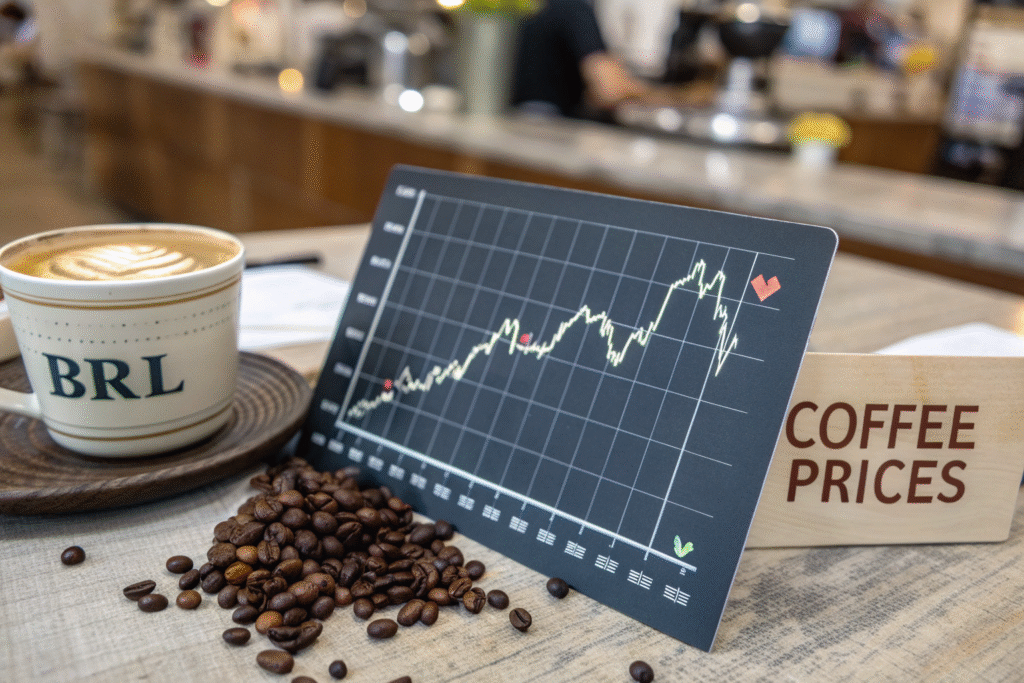

How Does the BRL/USD Exchange Rate Influence Global Prices?

The Brazilian Real is sometimes called "the coffee currency" because of its powerful influence:

- Weak Real: Brazilian farmers sell aggressively to lock in local currency gains, increasing global supply

- Strong Real: Brazilian farmers hold back coffee, waiting for better exchange rates, reducing global supply

This currency-driven supply response can swing global markets by 10-20% based solely on exchange rate movements, independent of physical coffee fundamentals.

Why Don't Other Producing Countries Counterbalance This?

While other countries' currencies matter, Brazil's market dominance (35-40% of global production) means its currency movements disproportionately influence global markets. Other producers like Vietnam (mostly Robusta) and Colombia face different cost structures and market positions, limiting their ability to offset Brazilian selling or holding patterns. This asymmetric currency impact concentrates influence in one country's exchange rate.

How Does Speculation Amplify Price Movements?

Coffee futures markets allow producers and buyers to hedge risk, but they also enable financial speculation that can disconnect prices from physical supply and demand.

Speculators who never take delivery of physical coffee can drive prices based on expectations, technical analysis, or portfolio allocation decisions that have little to do with actual coffee availability.

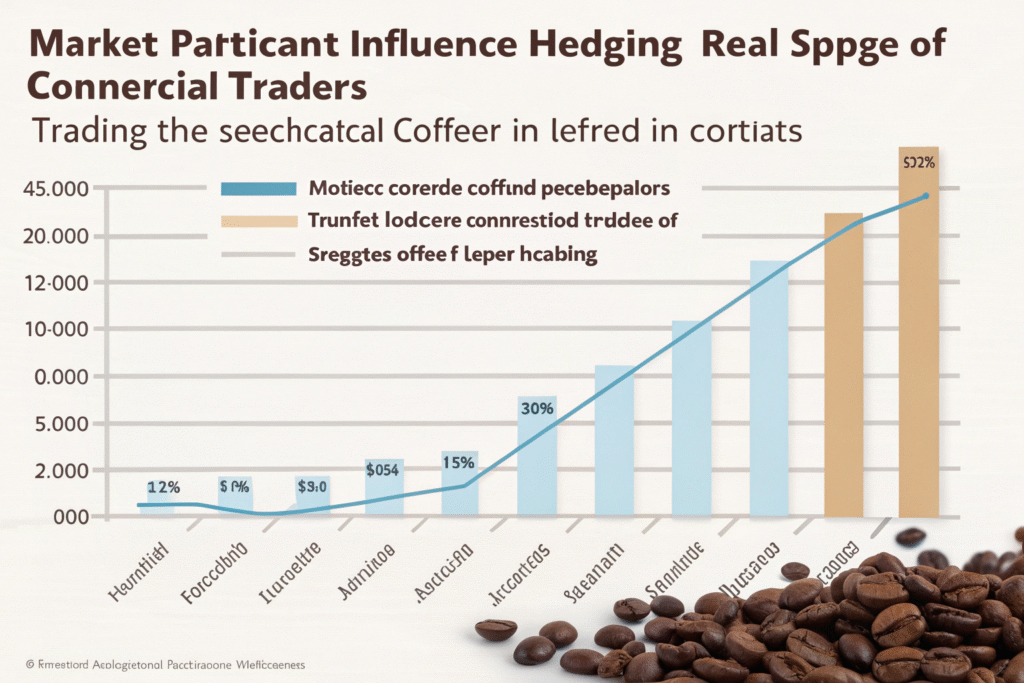

What's the Difference Between Commercial and Speculative Trading?

- Commercial traders (producers, roasters, exporters) use futures to lock in prices and manage business risk

- Speculative traders (hedge funds, algorithmic traders) seek profit from price movements without physical coffee involvement

When speculative positions dominate the market, prices can become disconnected from fundamentals, creating bubbles or crashes that don't reflect physical supply conditions.

How Much Influence Do Speculators Really Have?

Studies suggest speculative activity can account for 30-60% of short-term price movements. The 2011 coffee price spike, for instance, saw prices rise 100% then collapse within months—a pattern more consistent with speculative positioning than fundamental supply changes. This financialization of coffee adds another layer of volatility beyond agricultural realities.

What Structural Factors Create inherent Volatility?

Beyond temporary disruptions, coffee suffers from structural characteristics that make sustained price stability nearly impossible.

The multi-year production cycles, concentrated geography, and inelastic demand create conditions where small supply changes cause large price movements.

Why Can't Supply Respond Quickly to Price Signals?

Coffee has inherent response lags:

- New trees take 3-4 years to produce commercially

- Farmers can't easily switch between coffee and other crops

- Production decisions must be made years before harvest

- Abandoned farms can't be quickly reactivated

This production inertia means shortages can't be quickly addressed, while gluts can't be quickly resolved, creating boom-bust cycles.

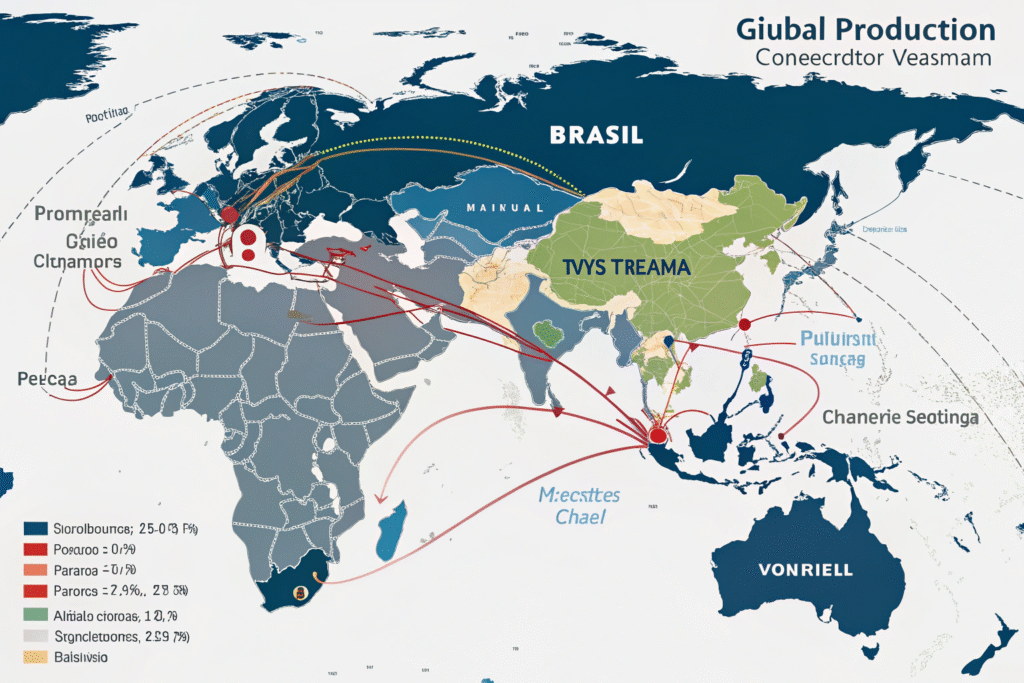

How Does Market Concentration Increase Vulnerability?

Just two countries—Brazil and Vietnam—produce over 50% of the world's coffee. This geographic concentration creates systemic risk:

- Weather events in these regions affect global supply

- Political decisions in one country impact global markets

- Infrastructure problems (ports, roads) can bottleneck supply

- Pest outbreaks can spread rapidly through concentrated areas

This supply chain fragility means localized problems quickly become global price shocks.

How Can Businesses Manage This Volatility?

While individual businesses can't control global coffee prices, they can implement strategies to mitigate volatility's impact on their operations.

Successful companies use a combination of financial hedging, supply chain diversification, contract strategies, and pricing models that account for inherent volatility.

What Hedging Strategies Work for Roasters?

- Futures and options to lock in prices for future needs

- Fixed-price contracts with suppliers when prices are favorable

- Diversified sourcing across multiple regions and seasons

- Strategic inventory to ride out short-term price spikes

- Price adjustment clauses in customer contracts

At BeanofCoffee, we help our partners develop volatility management strategies because we understand that price stability is as important as quality consistency.

How Can Supply Chain Relationships Help?

Long-term partnerships provide advantages:

- Priority access during shortages

- Transparent cost structures during price increases

- Flexible contracting that shares risk appropriately

- Early warning of potential supply issues

- Joint planning for climate resilience

These relationship advantages often provide more sustainable protection than purely financial instruments.

Conclusion

Coffee bean prices fluctuate dramatically because of a perfect storm of factors: weather sensitivity in concentrated growing regions, currency translation effects, speculative financial activity, and structural production lags. This volatility isn't an anomaly—it's inherent to coffee as a globally traded agricultural commodity with inelastic supply and demand characteristics.

The businesses that thrive in this environment aren't those that try to predict prices, but those that build resilient operations capable of weathering inevitable volatility. This means diversifying supply sources, developing strong supplier relationships, implementing smart hedging strategies, and creating pricing models that account for coffee's inherent instability. If you're looking for a supply partner that understands and helps manage this volatility, contact our export manager, Cathy Cai, at cathy@beanofcoffee.com. We've built our business around providing both quality consistency and supply reliability in an inherently unstable market.